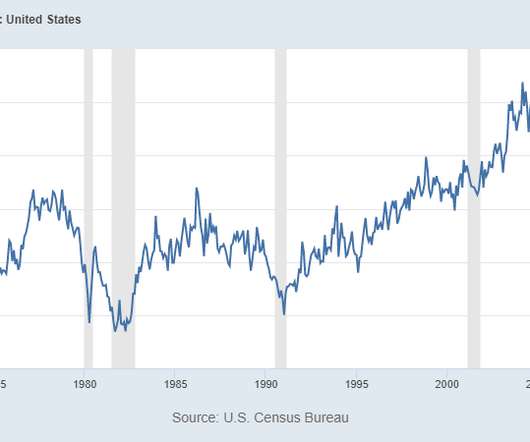

Home prices haven’t risen this fast since 2005

Housing Wire

MAY 25, 2021

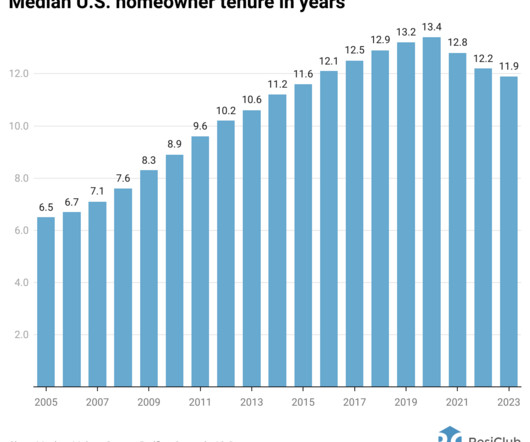

The March gain is also the largest since December 2005 and is one of the largest in the index’s 30-year history, said Craig Lazzara, managing director and global head of index investment strategy at S&P DJI. This demand may represent buyers who accelerated purchases that would have happened anyway over the next several years.

Let's personalize your content