Housing market stays hot into fall with mortgage applications up 6.8%

Housing Wire

SEPTEMBER 23, 2020

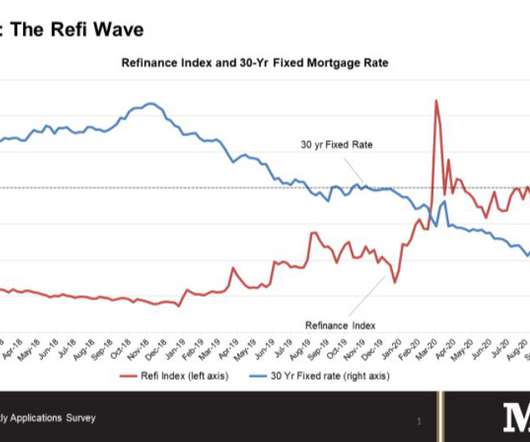

According to Mike Fratantoni, chief economist and vice president of research and technology at MBA, 2003 was the last time refinance activity was as high as the $1.75 The post Housing market stays hot into fall with mortgage applications up 6.8% of total applications from 62.8% the week prior. appeared first on HousingWire.

Let's personalize your content