Mortgage applications fell another 3.1% last week

Housing Wire

AUGUST 9, 2023

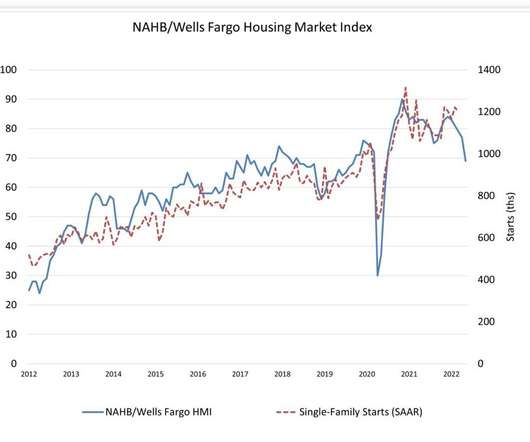

Mortgage applications fell for the third consecutive week as the 30-year fixed mortgage rate rose to its highest level since November 2022 at 7.09%. For the week that ended August 4, mortgage applications fell 3.1% from the prior week , according to data from the Mortgage Bankers Association. The downgrading of the U.S.

Let's personalize your content