‘There will be bank failures,’ Fed chief tells lawmakers

Housing Wire

MARCH 8, 2024

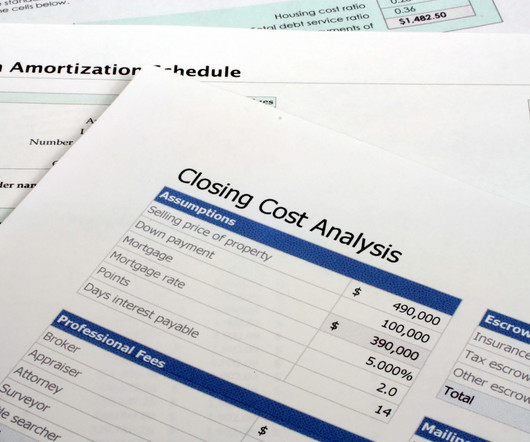

These stressors are tied to the post-pandemic increase in remote work, as well as higher interest rates that have made it difficult to refinance commercial real estate debt. “I When the FDIC rescued Silicon Valley Bank and Signature Bank in March 2023, the price tag was $22 billion.

Let's personalize your content