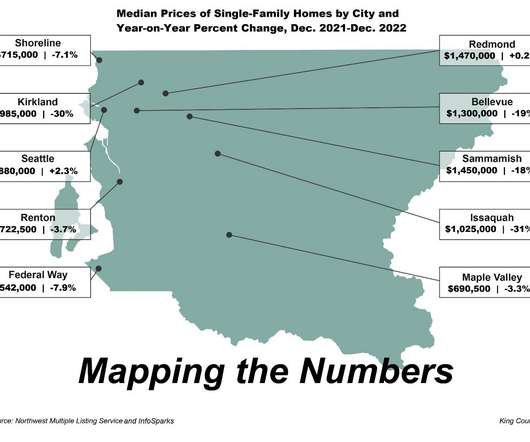

Opinion: To redress racial bias in mortgage underwriting, scrap the credit score

Housing Wire

APRIL 5, 2024

mortgage industry recently had to remind itself of this fact when a CNN analysis found that the nation’s largest credit union, Navy Federal, has the widest disparity in mortgage approval rates between white and black borrowers of any major lender. Is the mortgage industry offering fair access to loans? credit histories.

Let's personalize your content