Helping Lenders Navigate the Commercial Real Estate Appraisal Process

Simonson Real Estate

DECEMBER 6, 2022

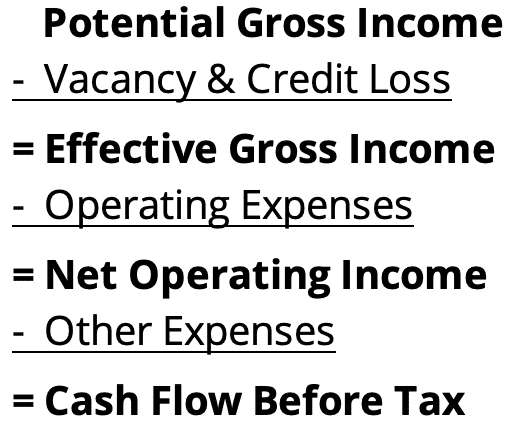

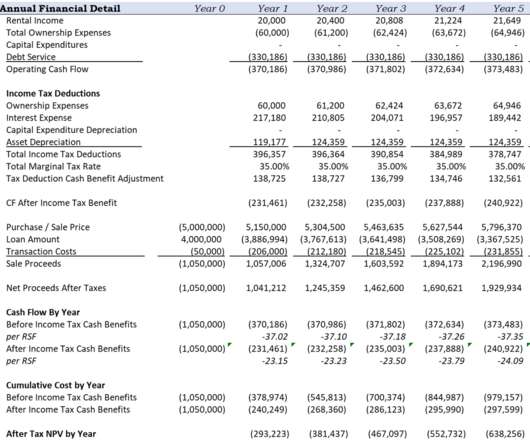

Lenders work with real estate investors and owners of small, medium and large businesses (borrowers) to help them secure financing to purchase and refinance real estate that fit their investment criteria and fulfill their business needs. Examples: A building owner has a single lease or multiple leases with tenants.

Let's personalize your content