Introduction to Lease vs. Own Commercial Real Estate Analysis

Property Metrics

JUNE 15, 2021

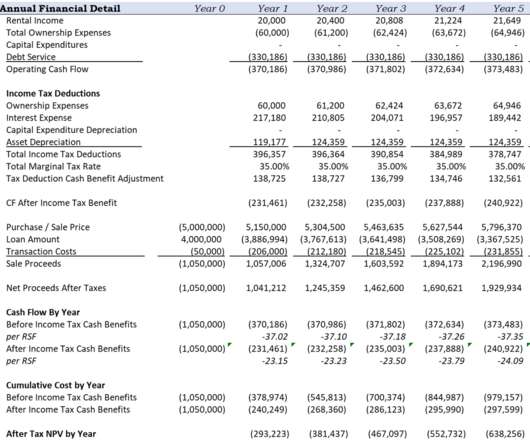

Property owners benefit from increases in the asset’s value over time and from the tax benefits of depreciation. In addition, they may benefit from leasing excess space to other tenants, favorable loan interest rates, and the comfort in knowing that their rent isn’t subject to the whims of a landlord.

Let's personalize your content