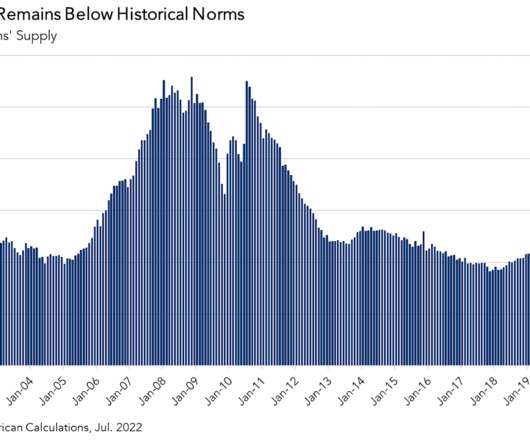

Housing Market Tracker: Inventory falls even lower

Housing Wire

APRIL 16, 2023

Mortgage rates didn’t move much last week, but the 10-year yield rose even though inflation data was tamer than expected, and we had a weaker retail sales report number. Mortgage rates didn’t move too much last week but ended the week on a higher note at 6.50%. This is one reason housing inventory has taken so long to bottom out.

Let's personalize your content