MBA: Applications for New Home Purchases Increased 1 Percent in March

Appraisal Buzz

APRIL 16, 2024

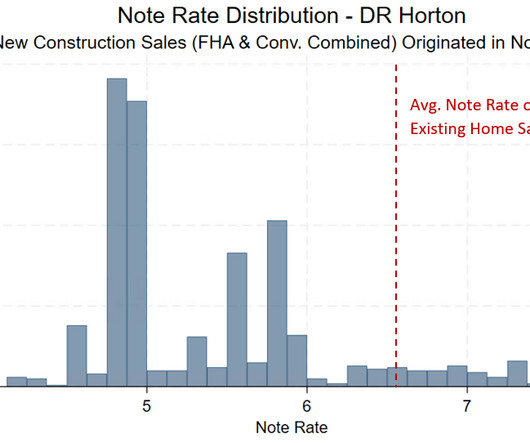

Applications for mortgages for new home purchases increased 1% in March compared with February and were up 6.2% compared with March 2023, according to the Mortgage Bankers Association (MBA). Applications were still ahead of last year’s pace, but at 6 percent, the annual growth rate was the slowest since September 2023.”

Let's personalize your content