Did lower mortgage rates slow housing inventory growth?

Housing Wire

MAY 4, 2024

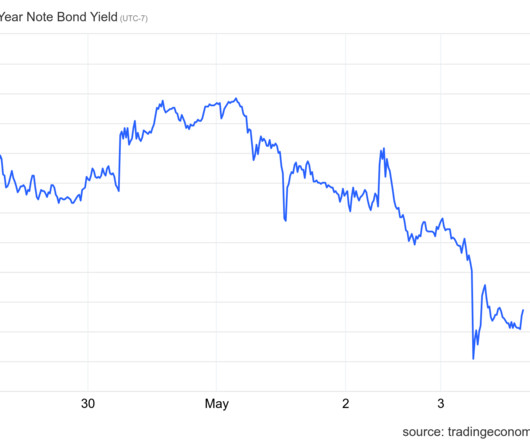

This can explain why the slope of the price-cut curve was faster and stronger in 2022 than in 2023 or so far in 2024. After two weeks of significant increases , inventory growth slowed dramatically and is far from my 11,000-17,000 growth model with mortgage rates over 7.25%. Let’s delve into the weekly data to see what we can uncover.

Let's personalize your content