Remember liar loans of a decade ago? Those same people want to do away with appraisers.

Miller Samuel

NOVEMBER 30, 2018

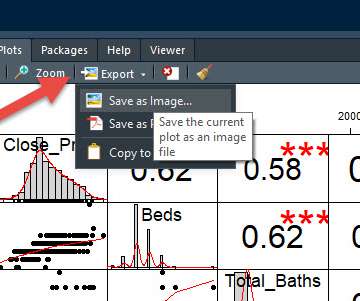

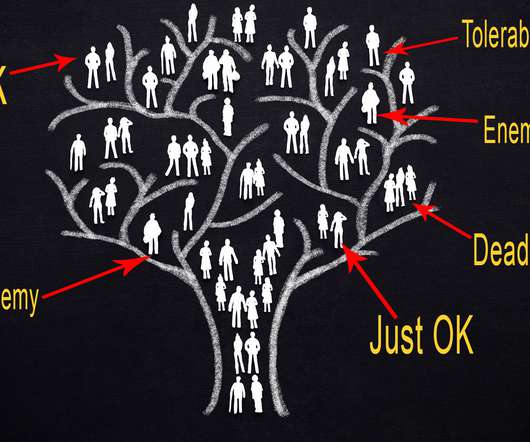

My friend and appraisal colleague Ryan Lundquist and I authored a petition on change.org to point out the growing wreckless behavior that is enveloping the mortgage process. There’s a proposal from the FDIC, Federal Reserve, and Treasury Department not to require appraisals for some mortgages under $400,000. As we say in the petition , this change can impact several groups in particular: consumers, the taxpayers, the housing market and appraisers.

Let's personalize your content