Have mortgage rates peaked for this cycle?

Housing Wire

NOVEMBER 4, 2023

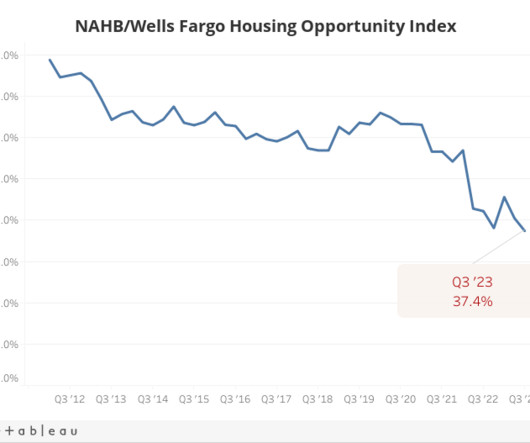

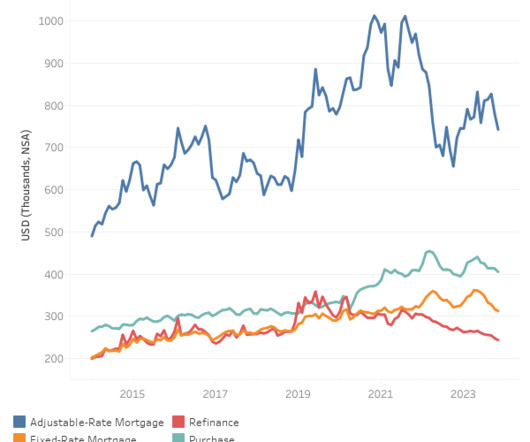

After mortgage rates spiked to 8% in October, causing a riot in the real estate industry, we had an epic move lower in mortgage rates last week. Does this mean we’ve hit the peak in mortgage rates for this economic cycle? The history of economic cycles and mortgage rates would say yes, but only if the market believes the Federal Reserve is done hiking rates and being hawkish and the labor data gets softer from here.

Let's personalize your content