Fewer homes will take a price cut in spring 2024

Housing Wire

JANUARY 6, 2024

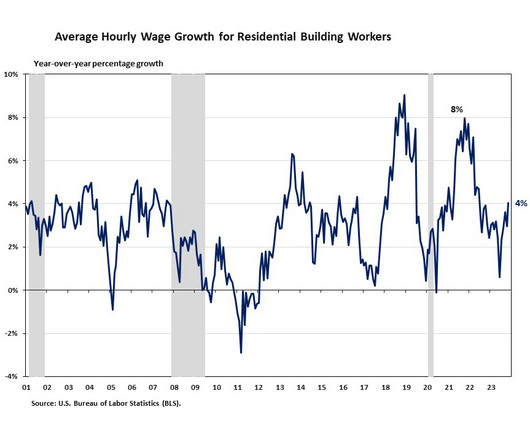

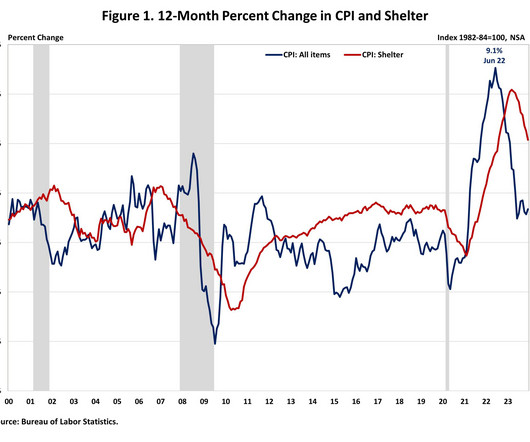

Will the number of homes that take a price cut this year drop below 2023 levels? Yes! If the current trends continue into the strong seasonal pricing period, we will see fewer homes that are discounted before selling. I believe this was the most overlooked housing story of the last year because even as mortgage rates rose all the way to 8% , the home price cut percentage data was always about 4% lower year over year.

Let's personalize your content