Housing inventory is barely positive heading into fall

Housing Wire

SEPTEMBER 10, 2023

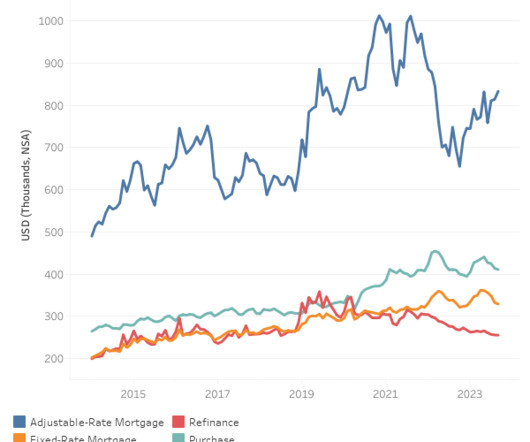

Last week we saw a noticeable decline in new listings and active inventory was barely positive. Does this mean housing inventory has begun its seasonal decline? Here are the weekly numbers: Weekly active listings rose by only 343 Mortgage rates rose from 7.08% to end the week at 7.22% Purchase apps fell 2 % week to week Weekly housing inventory At first glance, it seems we’re now seeing the seasonal active inventory decline since new listings data fell noticeably and active listings slowe

Let's personalize your content