What will lower mortgage rates do to spring housing inventory?

Housing Wire

NOVEMBER 25, 2023

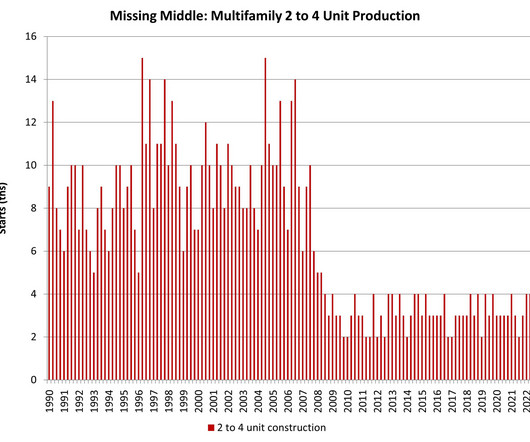

Lower mortgage rates tend to take housing supply off the market and demand has been picking up lately as rates have fallen. However, the recent drop in housing inventory has more to do with seasonality factors than lower mortgage rates. Higher mortgage rates did push inventory higher during the seasonal period when it would normally be declining. However, seasonality tends to rule the day eventually.

Let's personalize your content