Will we start 2022 with all-time lows in housing inventory?

Housing Wire

DECEMBER 8, 2021

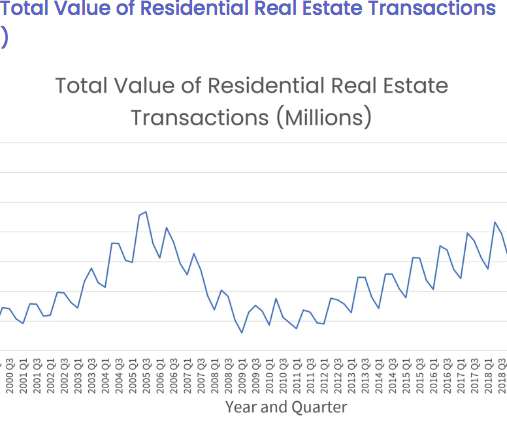

My biggest concern for housing in the years 2020-2024 was that if the demographic push in demand picks up and total home sales get over 6. 2 million , we could be at risk of housing inventory falling to such low levels that I would have to categorize this housing market as unhealthy. 2020 and 2021 easily each have over 6.2 million new and existing home sales combined.

Let's personalize your content