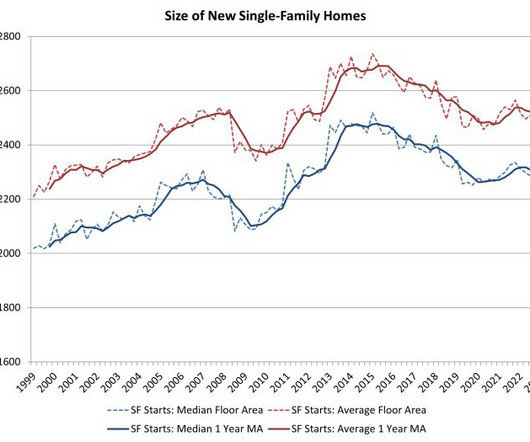

New Single-Family Home Size Trending Lower

Eyes on Housing

MAY 22, 2023

An expected impact of the virus crisis is a need for more residential space, as people use homes for more purposes including work. Home size correspondingly increased in 2021 as interest rates reached historic lows. However, as interest rates increased in 2022, and housing affordability worsened, the demand for home size has trended lower. According to first quarter 2023 data.

Let's personalize your content