MBA: Mortgage apps decline 2.3% to four-year low

Housing Wire

JUNE 1, 2022

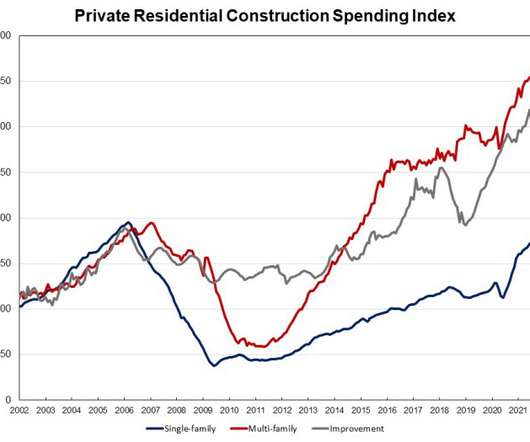

Mortgage apps dropped 2.3% for the week ending May 27, decreasing to the lowest level since December 2018, as measured by the Mortgage Bankers Association ’s (MBA) Market Composite Index. “Mortgage rates fell for the fourth time in five weeks, as concerns of weaker economic growth and the recent stock market sell-off drove Treasury yields lower,” said Joel Kan, MBA’s associate vice president of economic and industry forecasting.

Let's personalize your content