Predicting housing price cycles isn’t so easy

Sacramento Appraisal Blog

MARCH 1, 2022

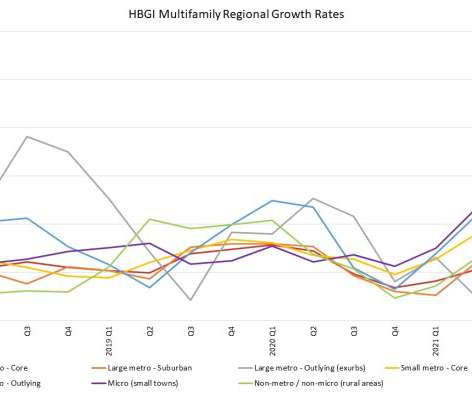

Does the housing market really have price cycles? Yes. But these cycles aren’t always so rigid and perfectly predictable like so many people think they are. Let’s talk about this today. I’d love to hear your take also. UPCOMING PUBLIC SPEAKING GIGS: 3/15/2022 NARPM Luncheon (details) 3/22/2022 SAFE Credit Union market update (details) 4/28/2022 SAR […].

Let's personalize your content