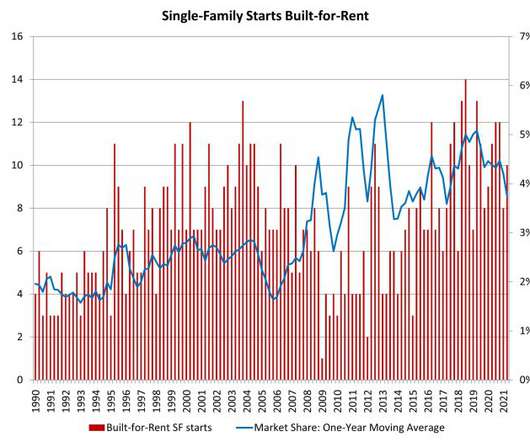

Why aren’t builders creating more housing inventory?

Housing Wire

AUGUST 18, 2021

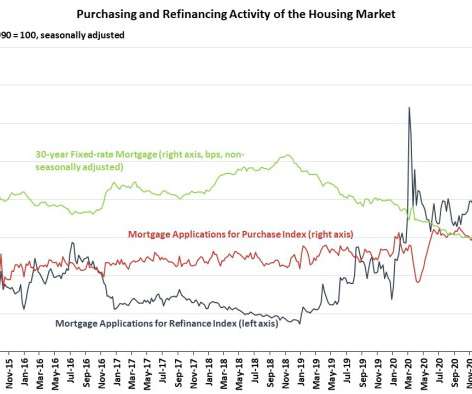

Today, the U.S. Census Bureau reported that housing starts hit 1,534,000 for July, missing estimates. Permits, on the other hand, beat estimates, coming in at a seasonally adjusted rate of 1,635,000. Positive revisions to the previous data were made, but not by very much. This mixed bag of results reflects the typical variability in the data that occurs when not too much has been happening in housing except that monthly supply has been rising for the new home sales market.

Let's personalize your content