Investors are buying more, but spending less

Housing Wire

OCTOBER 22, 2021

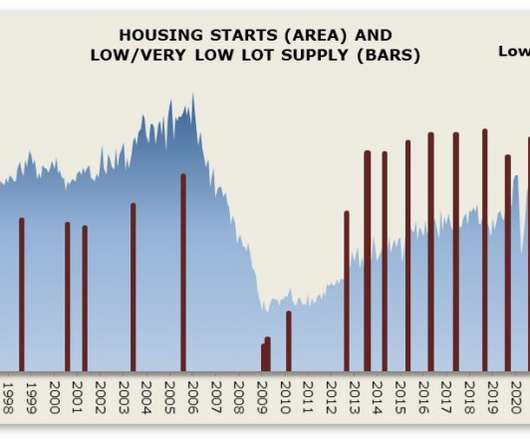

Real estate investors are buying more properties, but paying less for them, according to a report from RealtyTrac released Thursday based on ATTOM Data Solutions home sales data. In the second quarter of 2021, investor purchases accounted for 15.4% of all home purchases nationwide, compared with 11.5% of all home purchases a year prior. Despite such a large year-over-year change, it is still slightly lower than Q1 2021 , in which investors held 15.9% of the market.

Let's personalize your content