RealReports enhances property document analysis with new multimodal AI feature

Housing Wire

MAY 16, 2024

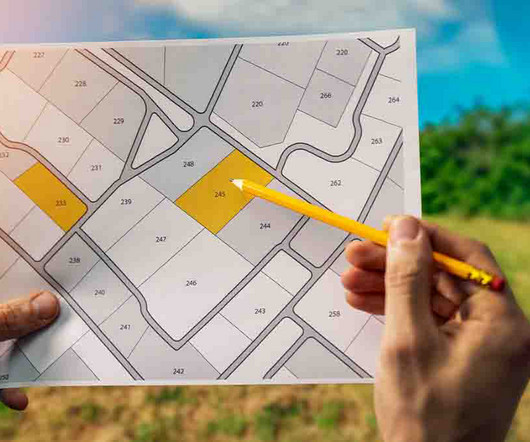

The new feature harnesses the capabilities of multimodal artificial intelligence to instantly analyze and summarize complex property documents, including inspection reports, appraisals and seller disclosures. It can also help agents clearly communicate their unique value and services to homebuyers, sellers and others.

Let's personalize your content