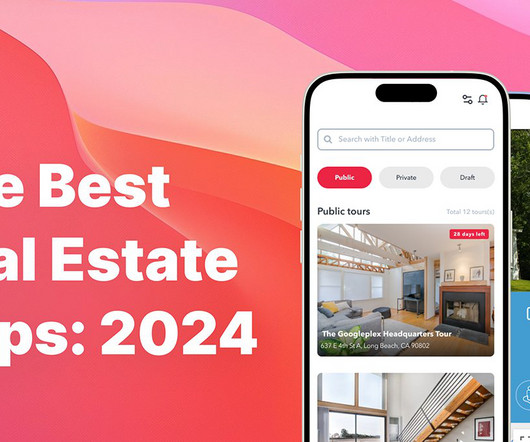

14 indispensable AI tools for real estate agents

Housing Wire

MARCH 13, 2024

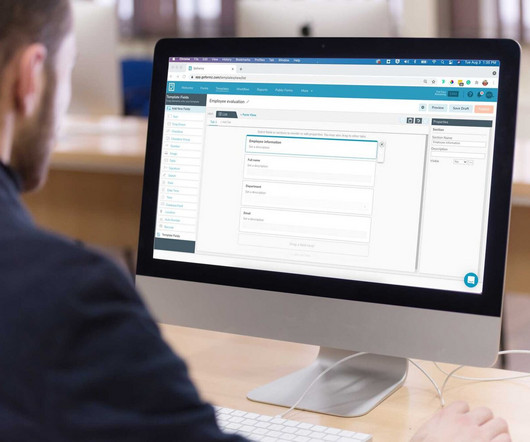

Artificial intelligence (AI) tools equip real estate agents with unprecedented capabilities. While ChatGPT has become a go-to tool for many of us, predictive analytics tools offer a more efficient, data-driven approach to generating new client leads. When you buy through our links, we may earn a commission. Visit Top Producer 2.

Let's personalize your content