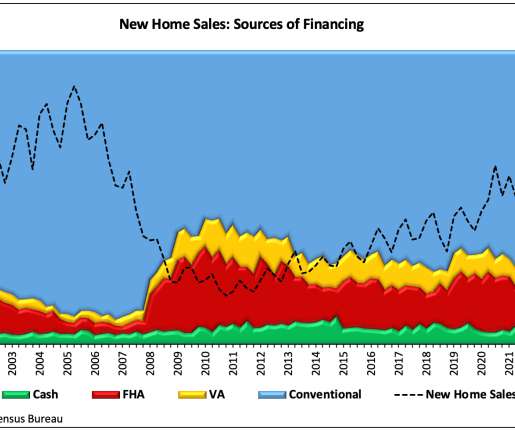

Conventional Loan Share of New Home Sales Reaches 13-Year High

Eyes on Housing

OCTOBER 29, 2021

Census Bureau reveals that conventional loans financed 75.7% of new home sales in the third quarter of 2021—the largest share since the beginning of the Great Recession in 2008. NAHB analysis of the most recent Quarterly Sales by Price and Financing published by the U.S. The share increased 1.7

Let's personalize your content