Opinion: Sitzer/Burnett decision presents an uncertain future for buyer agents

Housing Wire

NOVEMBER 20, 2023

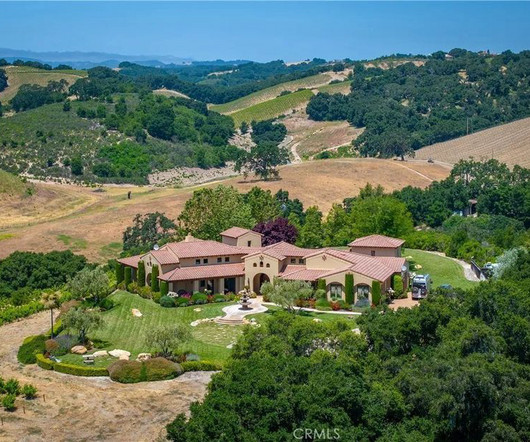

Real estate agents are facing a contracting issue that could seriously upend the traditional housing landscape. Under current guidelines, sellers pay a 5-6% commission on a sale which is split between the buyer and listing agents. Enter the savvy seller. But loan officers now have a new value add for listing agents.

Let's personalize your content