Unanswered Questions – Part 1

Appraisal Buzz

AUGUST 16, 2021

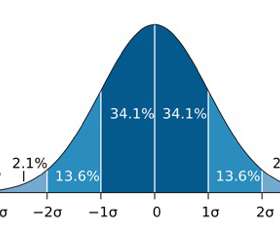

Fannie Mae defines market value in part as “the most probable price that a property should bring…” Thus, probability is the very foundation of the most common definition of market value. In other words, why are appraiser estimating market value below the contract price so often?

Let's personalize your content