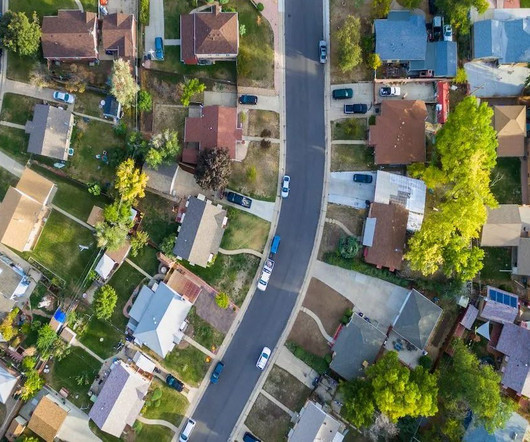

Mortgage demand rises ahead of key FOMC meeting

Housing Wire

SEPTEMBER 20, 2023

In the week leading up to the Federal Open Market Committee meeting, mortgage applications finally ticked up. 15, mortgage applications rose 5.4% from the prior week , according to data from the Mortgage Bankers Association. The refinance share of mortgage activity increased to 31.6% For the week that ended Sept.

Let's personalize your content