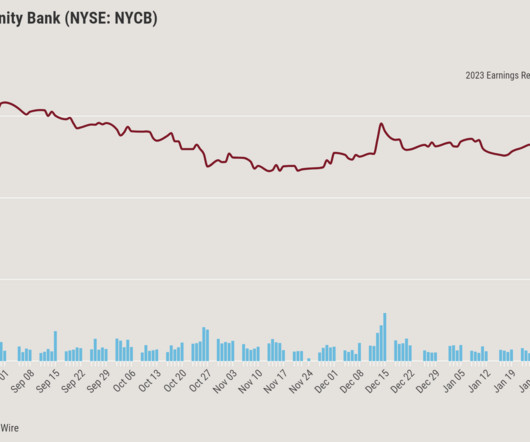

Financial services firm Consolidated Analytics acquires Real Info

Housing Wire

JANUARY 23, 2024

With the acquisition , Consolidated Analytics expands its valuation solutions, offering clients tools — from data and analytics to appraisals — to predict market value and access a more comprehensive selection of collateral assessment products, the company said.

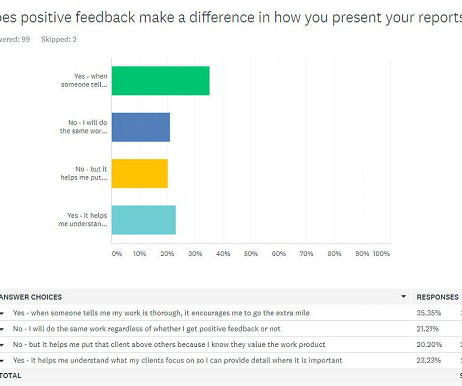

Let's personalize your content