In this brutal housing market, you’ll need to make $115K to buy the typical US home

Housing Wire

OCTOBER 20, 2023

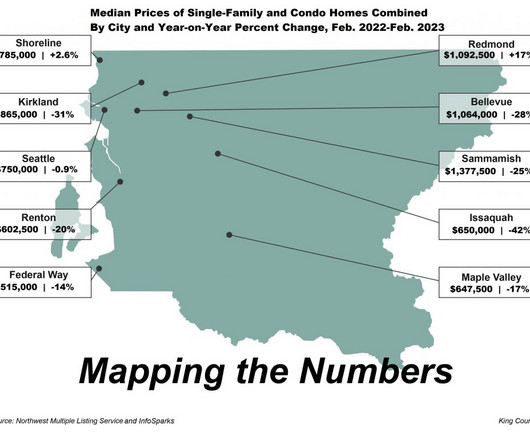

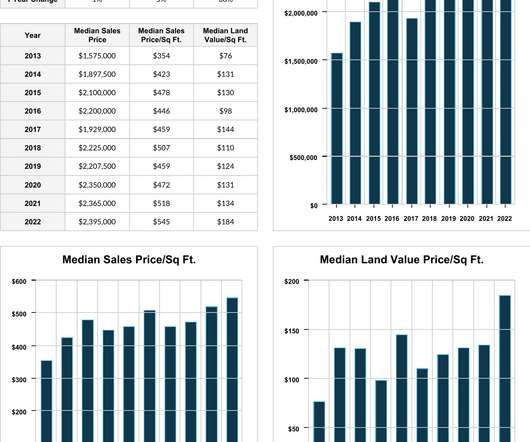

The last two years of soaring mortgage rates and rising home prices have brought the fastest erosion in housing market affordability in modern history, and it’s hurt first-time homebuyers the most. buyer hovers around $2,866, an all-time high according to Redfin. In Newark, buyers need $160,000.

Let's personalize your content