The opportunity cost of modern-day redlining

Housing Wire

APRIL 9, 2024

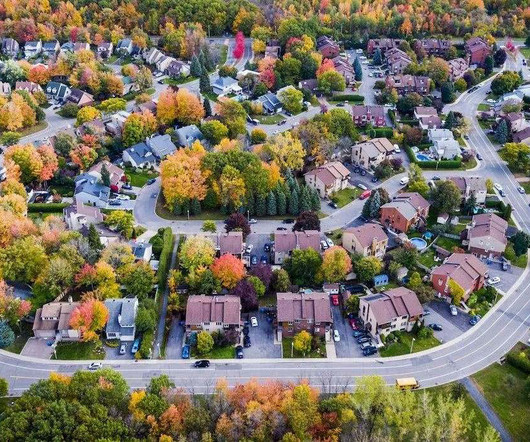

Modern-day redlining persists, and it’s costing lenders millions in legal fees. The cost of lost business opportunity is even higher. Forecasts in the industry predict that most mortgage growth over the next several years will come from MMCTs and BIPOC communities. The future of the mortgage industry is increasingly diverse.

Let's personalize your content