The Pitfalls of Outlier Sales in Pricing a Listing

Birmingham Appraisal

SEPTEMBER 26, 2023

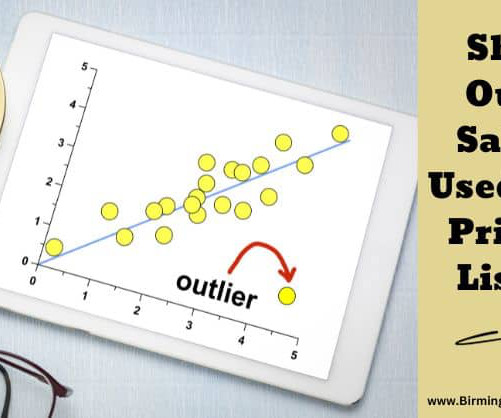

Some people will say that it is market value because you have a willing buyer and a willing seller. For sellers, this can be appealing, as it may justify a higher asking price. Including an exceptionally high sale in an area with mainly moderate values can give a false impression of what typical buyers and sellers can expect.

Let's personalize your content