Reverse mortgage volume, securities issuance fall in February

Housing Wire

MARCH 6, 2024

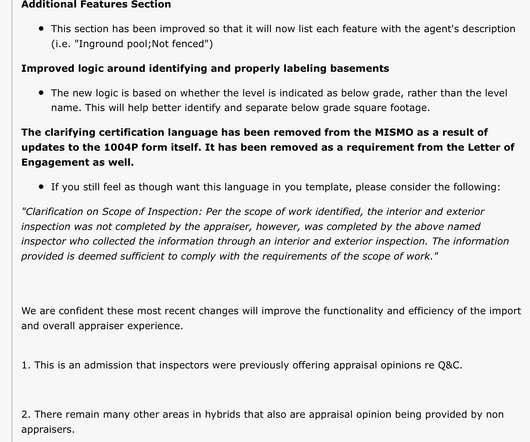

Leading lenders Among the top 10 lenders, only Goodlife Home Loans (a dba of Traditional Mortgage Acceptance Corp. ) Lunde said that’s particularly encouraging in the case of Longbridge, considering its trajectory over the past four months and the volume declines of other top 10 lenders in February.

Let's personalize your content