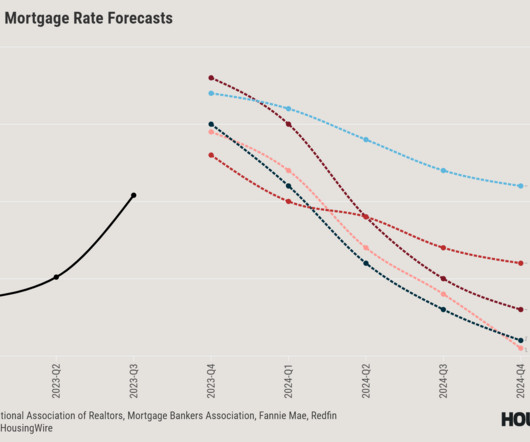

DataDigest: Breaking down housing economists’ 2024 forecasts

Housing Wire

DECEMBER 13, 2023

As 2023 draws to a close, housing professionals hope for relief from the high mortgage rates, terrible inventory levels and slow sales that characterized the year. They may find that relief for mortgage rates next year, according to forecasts from various industry experts compiled by HousingWire.

Let's personalize your content