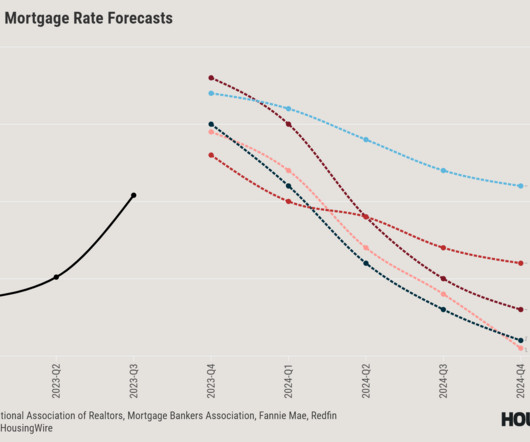

Here’s what you can expect from the 2024 housing market

Housing Wire

NOVEMBER 22, 2023

Going more in-depth than a Fed meeting, our virtual Housing Market Update event provides you with the strategy-building insights needed to operate in 2024. The number of home sales in 2023 will likely be at its lowest level since 2010, and while sales activity will pick up in 2024, transactions will still be below average.

Let's personalize your content