Property Tax Assessments and Revenue: Catching Up to Home Values…and Quickly

Eyes on Housing

JUNE 29, 2023

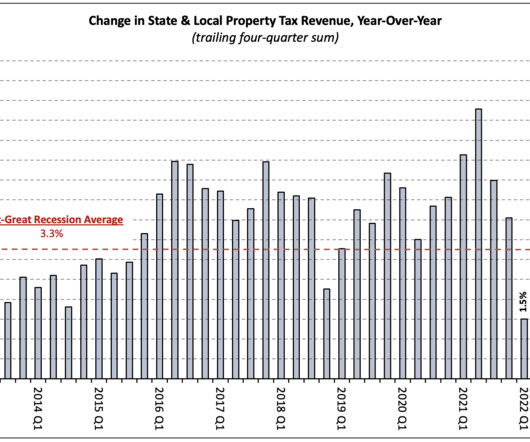

NAHB analysis of the Census Bureau’s quarterly state and local tax data shows that $174 billion in taxes were paid by property owners in the first quarter of 2023 (not seasonally adjusted).[1] 1] In the four quarters ending Q1 2023, state and local governments collected $714 billion of property tax revenue.

Let's personalize your content