These mortgage lenders have cut jobs in 2022

Housing Wire

JUNE 6, 2022

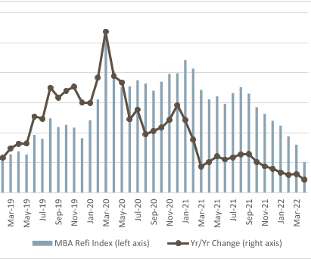

It’s a tough time for mortgage lenders. A rapid rise in mortgage rates and a big drop in origination volume has led to thousands of industry job losses over the last six months. By some estimates, origination volume will fall in 2022 to about $2 trillion, about half the volume from the record-breaking years of 2021 and 2020.

Let's personalize your content