5 best practices for improving the home equity lending experience

Housing Wire

NOVEMBER 10, 2023

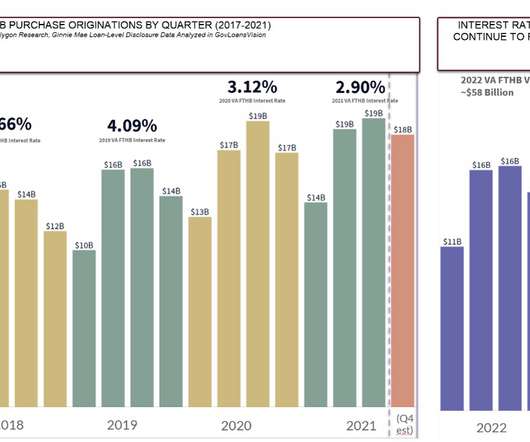

And that offers an incredible opportunity for banks and non-banks alike to improve their digital channels to better support home equity lending. Home equity line of credit (HELOC) and home equity loan originations increased 50% in 2022 compared to two years earlier, according to the Mortgage Bankers Association ’s Home Equity Lending Study.

Let's personalize your content