Secondary mortgage market adjusts to higher-for-longer rates

Housing Wire

MAY 2, 2024

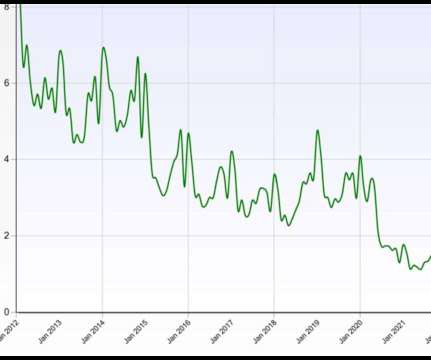

The housing market has been on a topsy-turvy roller-coaster ride in recent years that has been particularly neck wrenching since this past fall, fueled by stubbornly high inflation and a still-strong jobs market. Treasury market — jumping to as high as 121 in mid-April after ending March near 85.

Let's personalize your content