Highest and Lowest Property Tax Rates in Greater Boston

Lamacchia Realty

MAY 13, 2022

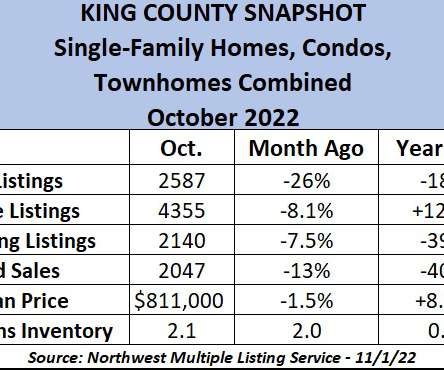

HIGHEST AND LOWEST PROPERTY TAX RATES IN GREATER BOSTON. The average single-family property tax bill in Massachusetts in 2022 is $6,719, up $347 from the previous year, according to a recent report conducted by the Division of Local Services, Massachusetts Department of Revenue. Seller Resources.

Let's personalize your content