Housing Market Tracker: Mortgage rates and inventory fall together

Housing Wire

MARCH 26, 2023

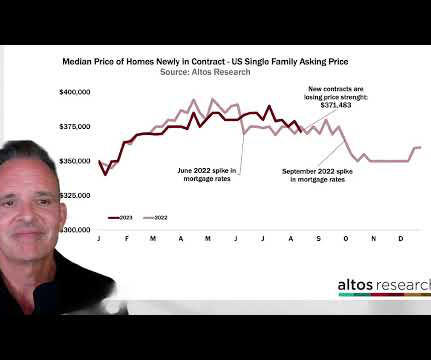

The financial and housing markets are still trying to sort out the banking crisis and whether we have seen the last Fed rate hike in this cycle. These events led to lower mortgage rates and increased purchase application data last week, but decreased housing inventory. In a regular market, they would be closer to 5.25%.

Let's personalize your content