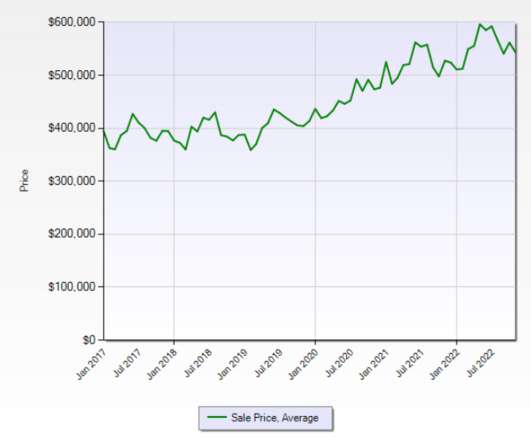

The 2022 housing market: A tale of two halves

Housing Wire

DECEMBER 27, 2022

Marty Green thinks of the housing market in 2022 as two very different movies. ” Houses were selling at a fever pitch in a matter of days, with multiple offers, waived contingencies and buyers paying $100,000(!) But the housing market in the second half of 2022? over asking price. High octane stuff.

Let's personalize your content