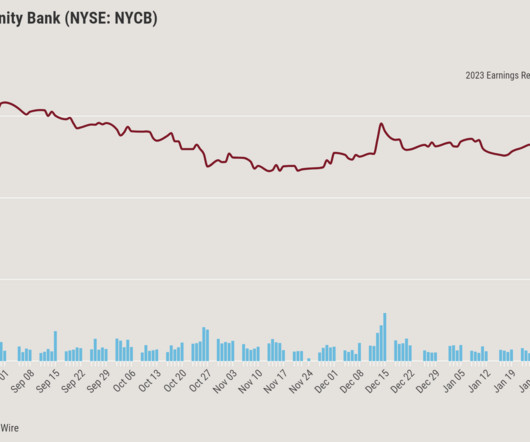

Figure hires banks for lending arm IPO: Bloomberg

Housing Wire

NOVEMBER 22, 2023

Mike Cagney’s financial technology firm Figure Technologies has taken another step to go public with its lending division, LendCo , hiring investment banks to coordinate the initial public offering (IPO), per a Bloomberg report. However, the report states there’s no final decision on the timing and valuation. for the IPO.

Let's personalize your content