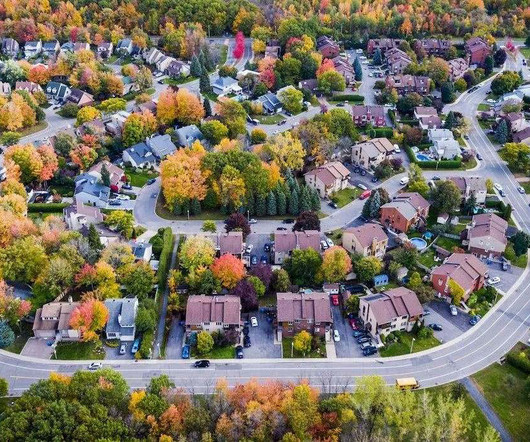

The opportunity cost of modern-day redlining

Housing Wire

APRIL 9, 2024

Modern-day redlining persists, and it’s costing lenders millions in legal fees. From 2020 to 2030, the Urban Institute projects 8.5 By shifting to a modern mindset and making diversity central to all lending initiatives, lenders can build strategies that are inherently anti-redlining. More recently, Patriot Bank paid $1.9

Let's personalize your content