Homepoint lends homebuyers the power of all-cash offers

Housing Wire

MAY 11, 2022

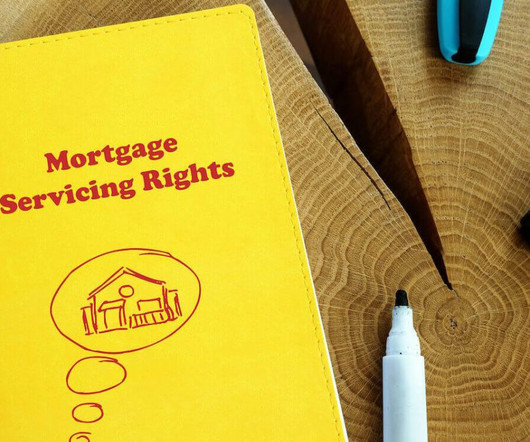

In this hot housing market, Michigan-based wholesale lender Homepoint understands the key to originating more home loans is ensuring more sellers accept offers made by its buyers. Planet Home Lending entered into a $2.5 The post Homepoint lends homebuyers the power of all-cash offers appeared first on HousingWire.

Let's personalize your content