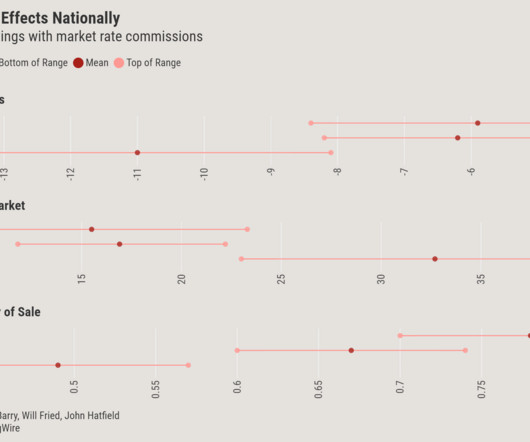

Redfin: Declining Home Affordability is Hitting America’s Low-Income Buyers Hardest

Appraisal Buzz

MAY 6, 2024

There was a sweet spot in 2020 when mortgage rates were ultra low and home prices had yet to skyrocket, allowing some lower-income Americans to break into the housing market,” says Elijah de la Campa, senior economist for Redfin, in the report. Low-income earners gained ground at the start of the pandemic, taking out 23.2%

Let's personalize your content