Opinion: Here’s the latest data on what Realtors are witnessing in the housing market

Housing Wire

OCTOBER 1, 2022

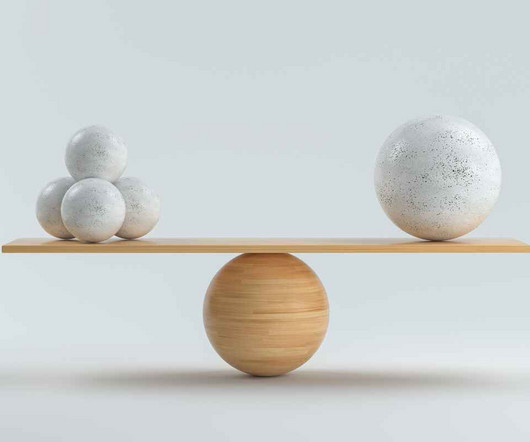

However, there are a number of attention-grabbing headlines, which unfortunately only compare today’s housing market to the very recent history of the last two years. It is always good to know where we are with the real estate market, but it is essential to keep all data in historical perspective. . Historically 2.5

Let's personalize your content