Home sales drop in July as high interest rates spook buyers

Housing Wire

AUGUST 22, 2023

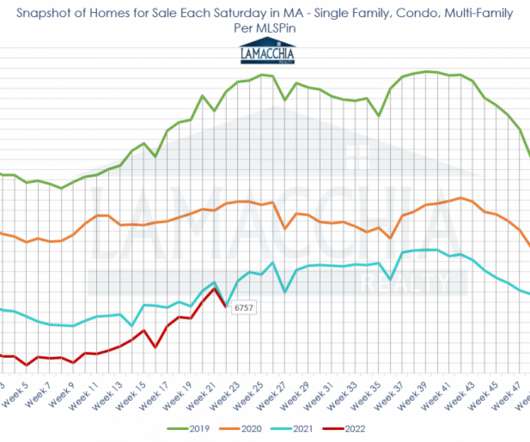

The housing market continues to cool amid high mortgage rates , low inventory and rising property insurance rates. The National Association of Realtors (NAR) suggested a 2.2% Elevated mortgage rates and low inventory As of August 17, mortgage rates surpassed 7% as U.S. bond yields hit their highest level since 2008.

Let's personalize your content