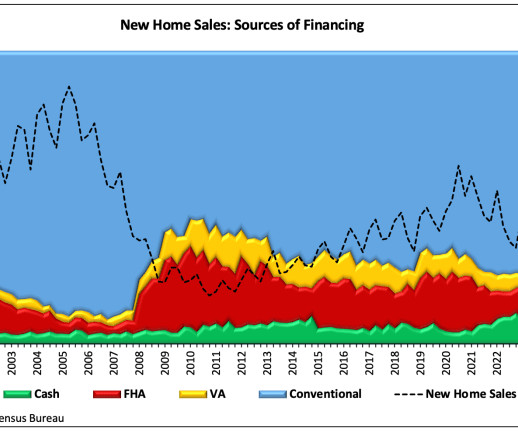

Is it 2007 again in the housing market?

Sacramento Appraisal Blog

SEPTEMBER 12, 2023

Is it 2007 again? There’s so much talk online about today’s housing market being like 2007, but what are the stats showing? UPCOMING (PUBLIC) SPEAKING GIGS: […] The post Is it 2007 again in the housing market? UPCOMING (PUBLIC) SPEAKING GIGS: […] The post Is it 2007 again in the housing market?

Let's personalize your content