Lower mortgage rates are stabilizing the housing market

Housing Wire

DECEMBER 7, 2022

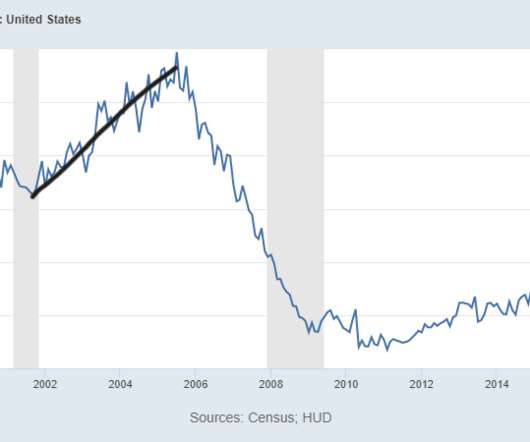

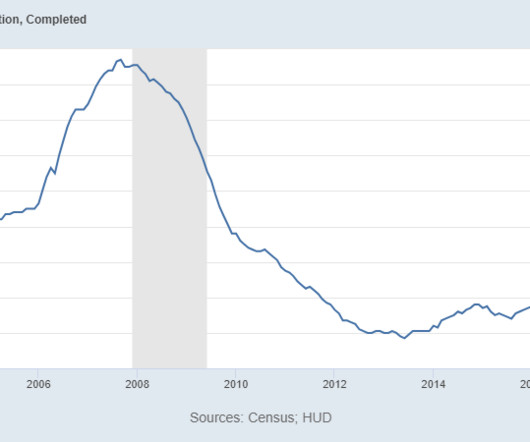

As you can see from the chart above, the last several years have not had the FOMO (fear of missing out) housing credit boom we saw from 2002-2005. What I mean by a credit bust is that after the housing bubble burst in 2005 into 2006, we saw a massive increase in supply. Total inventory levels.

Let's personalize your content