The 2021 housing market recap by Logan Mohtashami

Housing Wire

DECEMBER 29, 2021

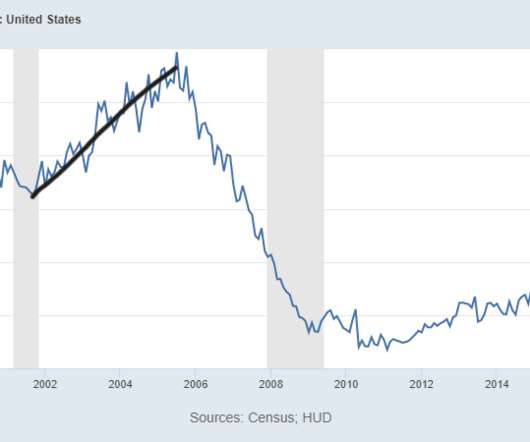

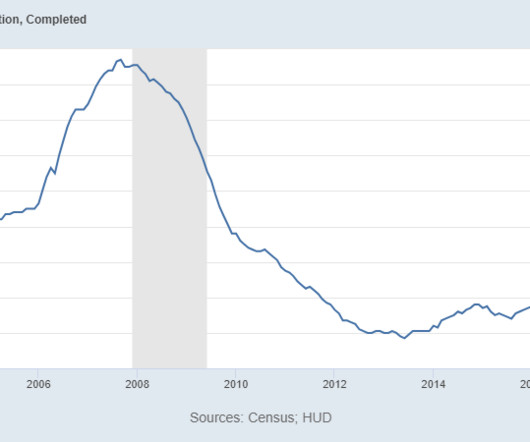

Housing permits are growing and this is a good thing for the economy and construction jobs. While I have never been a housing construction boom guy because mature economies typically don’t have a construction boom, the fact that permits are keeping their uptrend is a big positive for the United States of America.

Let's personalize your content